After witnessing the least volatile year during 2017 (with an annualised volatility of 8.9 percent), the Indian market has seen an uptick in volatility during 2018, with an annualised volatility of 12.5 percent.

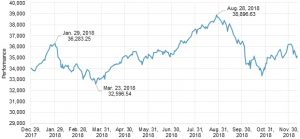

The calendar year 2017 noted significant returns after a few years of nearly flat returns. Continuing with the excitement, 2018 started with exuberance, as the S&P BSE Sensex reached more frequent lifetime highs through the end of January 2018.

However, it failed to sustain these highs. Immediately after the Budget was passed, the S&P BSE Sensex and all other leading indices experienced a sharp fall. As of December 13, 2018, the S&P BSE Sensex gained approximately 1,872 points YTD, up 6.8 percent, in terms of total returns.

After witnessing the least volatile year during 2017 (with an annualised volatility of 8.9 percent), the Indian market has seen an uptick in volatility during 2018, with an annualised volatility of 12.5 percent.

On the global front, higher oil prices, the US-China trade war, and global monetary tightening were the top three drivers of volatility.

On the domestic side, factors such as the introduction of the long-term capital gains tax on equity, perceived overall higher valuations of Indian equities, increasing interest rates, concerns over falling GDP, and lately, the non-banking financial company (NBFC) liquidity crisis kept the market volatile throughout the year.

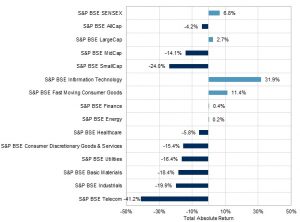

The S&P BSE AllCap, which covers more than 95 percent of India’s listed equity universe in terms of total market capitalisation, declined 4.2 percent. The declines in the S&P BSE MidCap (-14.1 percent) and S&P BSE SmallCap (-24.0 percent), with the simultaneous positive returns for the S&P BSE Sensex (6.8 percent) and S&P BSE LargeCap (2.7 percent) could be attributed to a shift in focus of investors from mid and small-cap stocks to relatively safer bets in large or mega-cap stocks.

On the sectoral front, the S&P BSE Information Technology and S&P BSE Fast Moving Consumer Goods noted gains of 31.9 percent and 11.4 percent, respectively. The revival in demand and sharp depreciation of the Indian rupee helped the Information Technology sector, whereas Fast Moving Consumer Goods stocks noted positive total returns, reflecting India’s consumption story.

Meanwhile, the S&P BSE Finance and S&P BSE Energy ended flat. The S&P BSE Telecom was the worst-performing sector index, with a total return of (-)41.2 percent — not surprising, given that most telecommunication services companies tend to be highly leveraged and are facing a potentially intense price war.

With the US-China trade war not cooling off, the IMF’s recent revision of the global GDP growth estimate to 3.7 percent in 2018 from 3.9 percent, and the downward bias in India’s GDP growth, the Indian equity market is expected to remain volatile in the near future. Market participants may also be interested in seeing how the government of India will respond to the recent losses in state elections, and how this may affect voter confidence in the upcoming general elections in 2019.

Pingback: grow room floor coating

Pingback: Replica wholesale rolex

Pingback: Hotels

Pingback: teacup english bulldog for sale near me

Pingback: keto diet review

Pingback: copy Tag Heuer Microtimer Watch

Pingback: dragon pharma eq 300

Pingback: Tattoo Supplies

Pingback: CBD Oil

Pingback: lo de online

Pingback: honda qq

Pingback: pinewswire.net

Pingback: knockoff cheap tag heuer imitation watches

Pingback: legit vendor dumps pin

Pingback: 웹툰사이트

Pingback: replica ladies stainless rolex

Pingback: replica rolex

Pingback: DevSecOps

Pingback: M-Audio DELTA 1010-AI manuals

Pingback: lace front wigs

Pingback: Login Area

Pingback: what is testing tools

Pingback: 뉴토끼

Pingback: usa dumps shop

Pingback: sell cc good

Pingback: Glo Carts

Pingback: 당근툰

Pingback: rent a scooter in honolulu

Pingback: videotranscriptionservices.net

Pingback: buy psilocybin chocolate bars

Pingback: fentanylplåster placering

Pingback: keltec ks7 for sale

Pingback: เงินด่วน

Pingback: psilocybin mushrooms for sale online

Pingback: bullet journal template