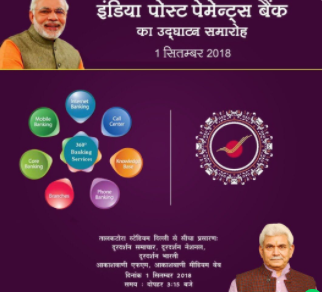

Prime Minister Narendra Modi is launching India Post Payments Bank, IPPB, at 3.15 pm. Some of the interesting facts.

1. It will be the newest player in payment space crowded by behemoths like Airtel Payments Bank and Paytm Payments Bank.

2. IPPB will have 650 branches and 3250 access points operational today at the time of launch.

3. 155,000 post office branches will be linked and operational by 31 December, 2018.

4. IPPB will be fully owned by the State. The budget for IPPB will be increased from 800 crores to 1435 crores.

5. IPPB will offer 4% interest on savings account and will take deposits upto 1 lakh in the accounts of individuals and small businesses.

6. IPPB will not extend loans. But they will tie up with third parties to extend other products. For example, they will tie up with Punjab National Bank to extend loans.

7. IPPB will offer a range of products such as savings and current accounts, money transfer, direct benefit transfers, bill and utility payments, and enterprise and merchant payments.

8. IPPB has been allowed to link around 17 crore postal savings bank accounts with its accounts. This will create a large base of existing customers for jumpstarting the operations.

9. 300,000 postmen and other employees will double as payment bank employees that will transform the moribund operations of post offices that was becoming a white elephant and a burden to exchequer.

10. This will be one of the largest exercises done by the present government on the lines of Jan Dhan Yojana, Demonetisation, GST and DBT touching almost 80% of the population.

WhatsApp us

WhatsApp us

Pingback: 카지노

Pingback: togel hongkong

Pingback: research firm

Pingback: emergency plumbing Pine Dale

Pingback: high quality replica watches

Pingback: Hallucinogens for Sale

Pingback: fun88.viet

Pingback: http://63.250.38.81

Pingback: keju qq

Pingback: titta på här nu

Pingback: airport taxi cheltenham to heathrow

Pingback: Mail order Marijuana online

Pingback: anime sex doll

Pingback: ความคิดเห็นของเขาอยู่ที่นี่

Pingback: credit card shop

Pingback: tangerine farms

Pingback: Best Roof Guy

Pingback: 안전놀이터

Pingback: 먹튀사이트

Pingback: kids swimming

Pingback: best replica rolex

Pingback: Kilmacduagh and Kilfenora

Pingback: best cvv

Pingback: replica watch imitation omega

Pingback: 카지노사이트

Pingback: sbo

Pingback: Continued

Pingback: magic mushroom microdose for sale

Pingback: sportsbet

Pingback: เงินด่วนออนไลน์

Pingback: maxbet

Pingback: Residual income

Pingback: cornhole bags

Pingback: meateater whiskey where to buy

Pingback: Dragon Tiger in Pokermatch