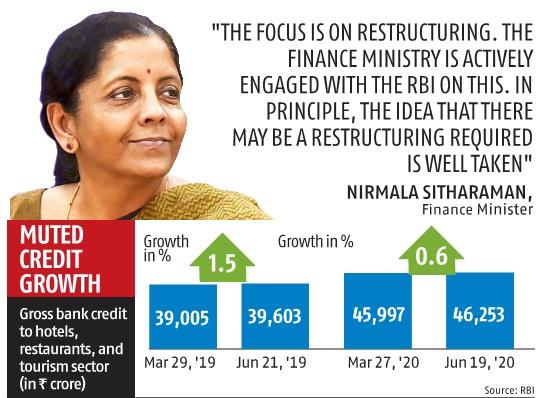

Union Finance Minister Nirmala Sitharaman on Friday said her ministry was working with the Reserve Bank of India (RBI) on extending the loan moratorium period for the hospitality sector, hit hard by the pandemic. She reiterated the ministry was talking to the RBI on restructuring loans for industry.

“I understand the requirements of the hospitality sector on extending the moratorium or (loan) restructuring. We are working with the RBI on this,” she told members of the Federation of Indian Chambers of Commerce and Industry (Ficci).

The RBI had extended the moratorium period for three months till August 31. There has been demand from the hospitality sector to extend the date.

For instance, the Hotel Association of India (HAI) has said the pandemic has destroyed more than 90 per cent of demand in the tourism and hospitality sectors, which employ nearly 45 million people. The hospitality sector wants a staggered approach to the rate of interest.

On the other hand, bankers are against extending the moratorium period. For instance, HDFC Chairman Deepak Parekh recently urged RBI Governor Shaktikanta Das not to do it.

Parekh said many entities capable of repaying were taking advantage of the scheme and this was hurting the financial sector, especially non-banking.

The finance minister also said work on setting up a development finance institution (DFI) was on.

“What shape it will take we will know shortly,” she added.

This assumes importance in the wake of the RBI governor recently saying that industry had to find new ways to fund infrastructure projects because banks, struggling with bad loans, would not be able to give them money.

A DFI is an entity owned generally by the government to fund projects that are unable to get loans from commercial lenders. There is dearth of such institutions in India. Most of them are sector-specific such as Rural Electrification Corp and the National Bank for Agriculture and Rural Development (Nabard).

The finance minister emphasised reciprocity in trading arrangements with countries to which India has opened up.

Sitharaman said banks could not refuse credit to micro, small, and medium enterprises (MSMEs) covered under emergency credit facilities. Banks have sanctioned Rs 1.3 trillion to MSMEs under this scheme as of July 23. Of that, Rs 82,065 crore has been disbursed.

Source: Business Standard

Pingback: cartel & co

Pingback: clase azul tequila 750ml

Pingback: pk789 สล็อต

Pingback: Codeless test automation tools

Pingback: discover here

Pingback: buy Blackberry Dream