Conserving cash amid COVID-19

COVID-19 caught many businesses by surprise, with many facing government-imposed operational restrictions, severe supply chain disruptions and declining consumer demand. The most serious impact, experienced by most if not all businesses, was on their finances, especially working capital.

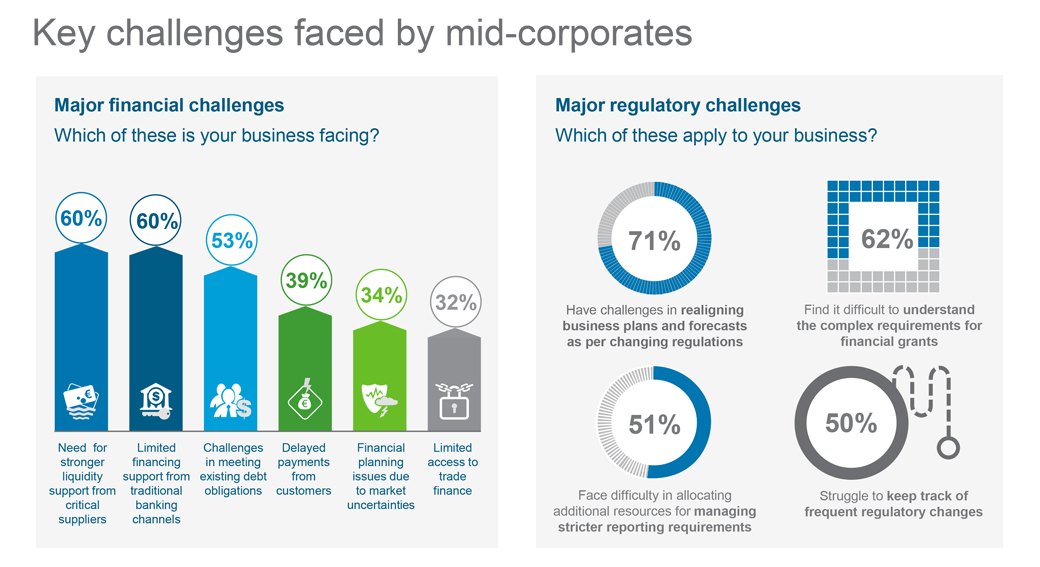

In our survey1 of 205 mid-corporates, 60 per cent of C-level executives said they face challenges in receiving financing support from traditional channels, and want stronger liquidity support from critical suppliers, while 39 per cent of them are facing delayed payments from customers. Given these scenarios, companies will need an effective finance strategy focused on preserving liquidity through immediate cash conservation measures to weather the effects of this ongoing crisis.

As economies re-open, companies are finding themselves in the ‘Preservation and Stability’ phase, i.e. Stage 2 of the ‘The Mid-Corporate Journey to Resilient Growth’. They are actively exploring ways to maximise revenues and re-evaluating their cost structures with an immediate need to optimise working capital.

Swift actions needed to tackle immediate financial and regulatory challenges

Besides the upheaval to their finances, mid-corporates also cited keeping up with regulatory developments as something they find challenging even as they grapple with revising business plans and forecasts in the face of fast-changing circumstances. Complying with stricter reporting and the myriad complex requirements in order to qualify for financial grants have added to their concerns.

While these challenges are not uncommon, the scale of impact is significant in a crisis of this nature. To overcome them, mid-corporates need to build a comprehensive and well-defined plan followed by swift execution.

Three key actions to take for an effective response to the immediate challenges

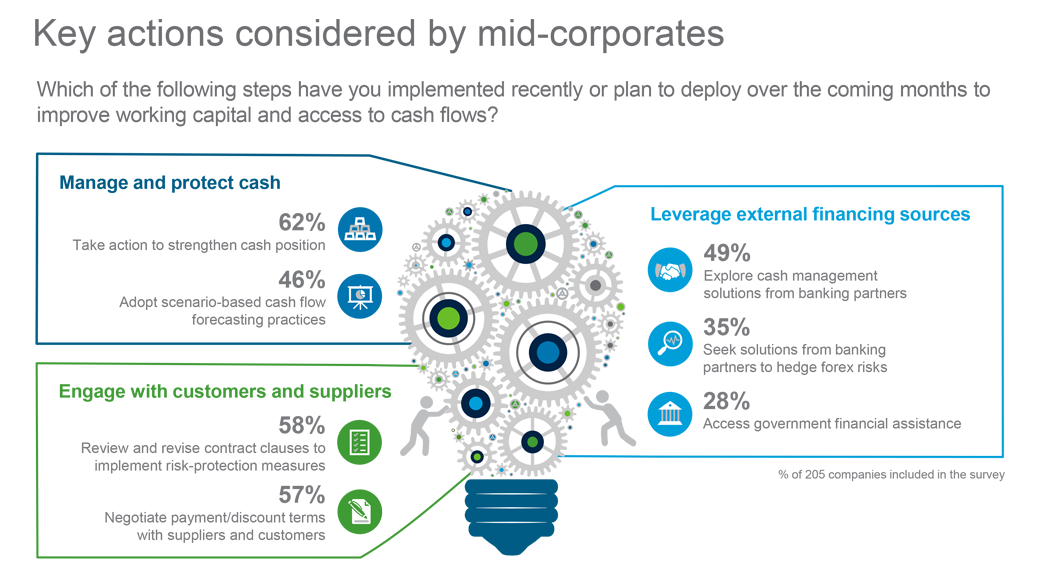

First action to take – Manage and Protect Cash

- Locate all available cash – Obtain a holistic view of the organisation’s cash and liquidity position by identifying the quantum of cash, its location globally (and currency) and whether it is available for use or tied-up. With the crisis still ongoing and the severity of its impact, this is a critical activity requiring a comprehensive, data-driven review of a company’s cash conversion cycle and adopting an end-to-end perspective of its supply chains.

- Adopt shorter term, scenario-based cash flow forecasting – Customise your existing cash flow forecasting models to incorporate shorter cycles (e.g. 13-week). At the same time, continually update and prepare for multiple possible scenarios including ‘worst-case scenario’ options. In periods of uncertainty, recognising what could trigger different scenarios and being able to quantify their impact on cash flows will help mid-corporates plan better for contingencies and take upfront action to mitigate any potential downsides and risks.

- Implement initiatives to free tied-up cash – Identify new opportunities across the supply chain for accelerating inventory flows (e.g. flash sales, finding alternative customer segments) whilst maintaining a stock safety buffer. Optimise inventory levels through the following:

- Adopt daily/weekly forecasting to recalibrate demand and supply requirements. Enhance this by utilising digital tools e.g. predictive analytics, where possible.

- Prioritise the most critical products and supplies (e.g. products with healthy margins, higher turnaround speed) and consider Stock Keeping Unit (SKU) rationalisation.

- Scrutinise new purchases, adjusting or redeploying where possible and pausing if required.

- Track legal and regulatory requirements – Keep abreast of changing regulations, reporting requirements and legal obligations to avoid any costly legal disputes, litigation, fines and other penalties. With the current situation being so fluid, mid-corporates – either directly or via industry associations – would do well to pro-actively engage with regulatory agencies on upcoming developments. This would be a good opportunity to address any concerns, provide inputs on proposed plans, get a good understanding of and plan for upcoming changes.

Second action to take – Engage with Customers and Suppliers

- Boost collections – Proactively engage and collaborate with customers to mutually agree on actions to reduce outstanding receivables. While this has always been a focus for mid-corporates, the current situation requires identifying more customised and mutually beneficial solutions, based on dialogue with strategic customers. A starting point would be to map out and concurrently engage with multiple stakeholders in the customer organisation (including the user department, finance and procurement), to expedite decision making. Some of the possible solutions that can be explored are:

- Revising payment terms (e.g. modifying collection schedules) based on discussions with key customers who have large outstanding payables.

- Providing discounts for early payments and introducing new payment terms to encourage faster cash collection.

- Implementing digital invoicing, e-transfers and other digital solutions for faster payments.

- Manage payments – Work together with suppliers and vendors to identify potential mechanisms for effectively managing payables, whilst avoiding any detriment to key relationships. A critical input for this activity would be prioritising the suppliers based on the strength of the relationship and the relative importance of the material or service they provide. Potential solutions for prioritised suppliers may include:

- Negotiating repayment terms and consider extending current credit lines with existing and new suppliers.

- Amending contract clauses in current supply contracts (e.g. cancellation or service suspension clauses) where feasible, and making sure that any new supply contracts include explicit risk-protection clauses.

- Exploring longer term contracts with select suppliers to obtain bulk discounts while offering continuity of business in exchange. This needs to be carefully managed, ensuring availability of alternate suppliers to avoid concentration risk.

Third action to take – Leverage External Financing Sources

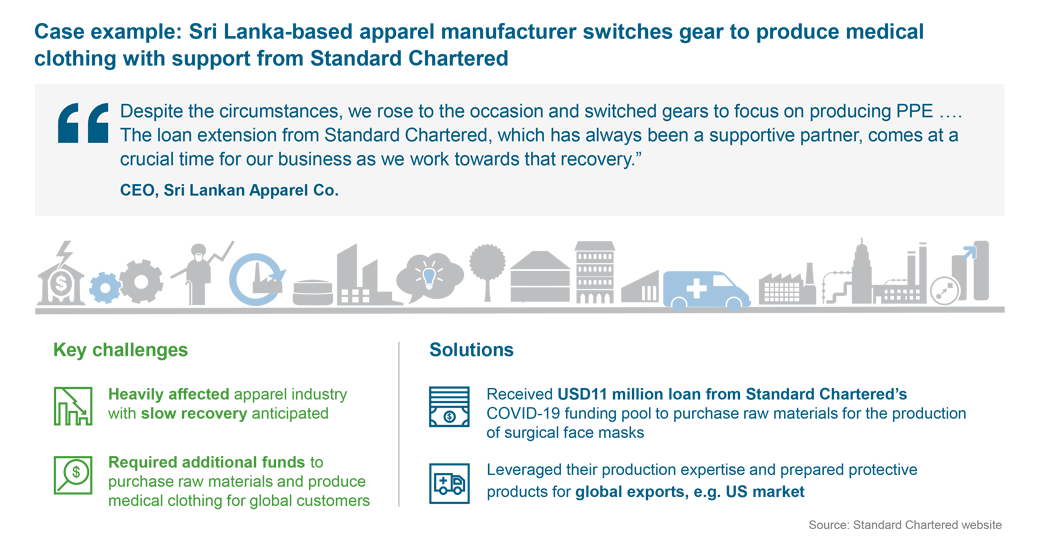

- Explore banking solutions – Actively engage your banking and financial services partners to identify and customise potential solutions that will maximise current working capital, with a view towards building a more strategic, longer-term relationship as opposed to a more transactional one. These would be in addition to traditional solutions and may include:

- Receivables financing, or invoice financing, to help with current and immediate cash needs. This could be especially useful for mid-corporates with customers in overseas markets.

- Foreign exchange hedging solutions to protect against losses arising from exchange rate fluctuations.

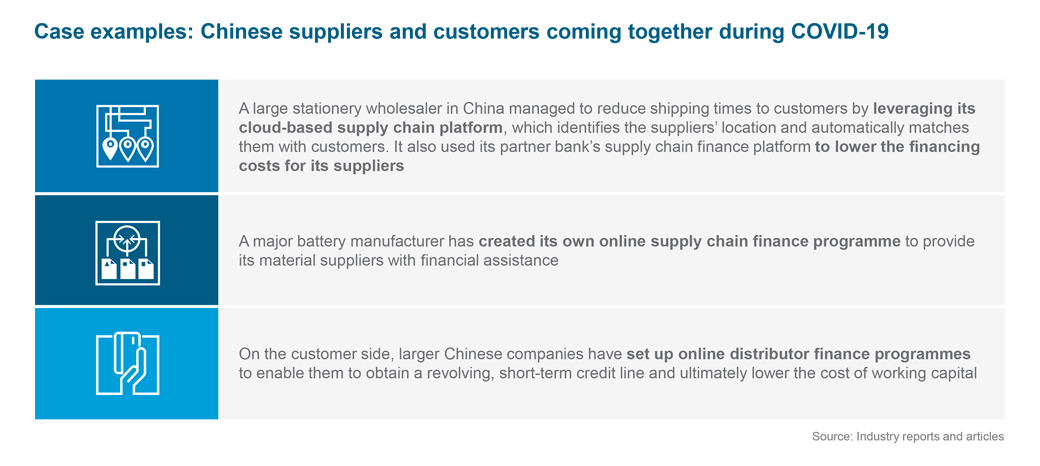

- Supply chain solutions that cover the end-to-end financial flows of supply chains, ensuring their stability and viability as well as strengthening the mid-corporates’ relationships with their business partners both upstream and downstream in the supply chain.

- Access government financial assistance – Understand and participate in relief programmes made available by governments and industry associations that provide quick access to cash, especially for small and mid-sized companies, such as:

- Grants or loans: e.g. temporary bridging loans, trade loans, loan holidays and moratoriums.

- Property: rental freezes, reliefs or rebates.

- Employment: salary subsidies, job support schemes, foreign worker levies.

- Benefits: reduction in social security contributions and pension obligations.

- Tax: corporate tax exemptions/waivers and tax filing deferrals.

- Contracts: reliefs from contractual disagreements.

Mid-corporates should also consider more active engagement with industry lobby groups to campaign for sector-specific policies around financial and other support to businesses during the COVID-19 crisis.

Managing working capital along the resilient growth journey

As companies progress along ‘The Road to Resilient Growth’ and enter Stage 3 (‘Preparing for Growth’), they should consider actions that will improve their cash position in the longer-term, such as realigning corporate real estate and manufacturing locations to map against revised operational capacity and leveraging digital technologies for cost-efficiencies (e.g. blockchain for trade finance).

The next point-of-view in our series will focus on alternative sources of capital and investments that mid-corporates can potentially tap into to further strengthen their capital base and enable this new phase in their journey towards resilient growth.

Source: Reuters

WhatsApp us

WhatsApp us

Pingback: https://www.contactlenshouse.com/currency.asp?c=CAD&r=https://phforums.co.za/playabet-south-africa-betting-review/

Pingback: bandar togel online