Islamabad: In a brief report published by the IPR titled “Pakistan’s debt and debt servicing is cause of concern”, the reasons behind the consistently crippling economy and towering debts and liabilities have been discussed in details, while the government has been criticised for weak economic management.

“We are in a debt trap that is entirely of our own making. It is a risk to our national security,” the IPR report said.

“The government was borrowing to repay the maturing debt, which now seems to be a concern for all the political parties, businessmen and experts,” the report added.

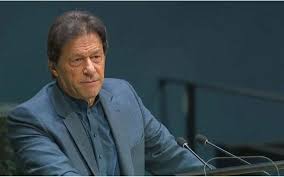

Interestingly, the IPR is run by senior PTI leader and former Commerce Minister Humayum Akhtar Khan, whose report seems to be taking a strong crack at its own ruling government led by Prime Minister Imran Khan.

The report states that Pakistan added a total of Rs 4.3 trillion to its debts and liabilities in the fiscal year 2019-20 only, which was equal to 10.4 per cent of the country’s gross domestic product (GDP).

“In two years, total debt and liabilities have grown by a massive 14.7 trillion,” the report said.

“This shows weak fiscal management as well an inability to stimulate growth in the productive sectors. It also reflects a failure to make the necessary reforms in the key sectors of energy and power,” the report added.

Further elaborating the dire condition of the country’s economy, the report stated that Pakistan’s total debt and liabilities stood at 107 per cent of GDP or Rs 44.5 trillion while gross public debt was equal to at least 87 per cent of GDP during the last fiscal that ended June 2020.

“Domestic debt has grown at an equal pace and external debt has also grown in US dollars,” the report stated.

While the IPR report put bare the Imran khan government’s failure to put financial reforms that would help decrease the country’s debt, the Ministry of Finance has insisted that public debt management has improved in the last fiscal, blaming the previous government for leaving behind a pile of debt, which impacted the cost of debt servicing.

But the IPR report refused to agree to the government’s claims and maintained that policies of entities like the central bank defy economic logic.

“High discount rate, with no apparent economic logic, slowed down the economy, and with it the tax revenue,” it said.

“Despite increase in power tariff, revenue collection by distribution companies did not improve. Consequently, in addition to government borrowings, public sector entities’ (PSEs) debt also increased.

“The PTI government has increased power tariffs by more than half in the past almost two years and yet the circular debt has touched the new historic high of Rs 2.4 trillion. The International Monetary Fund is again demanding an increase in power tariffs as part of its solutions to the power sector problems,” the IPR report added.

Pakistan’s external debt and liabilities have swollen from $95 billion in 2018 to about $113 billion by end of the last fiscal, a worrisome addition of $17.8 billion to the total external debt and liabilities in two years only.

The IPR report expressed serious concerns over the increasing borrowings of the Imran Khan-led government.

“As the debt is used mostly to balance the payments and budgetary support, there is no way of knowing how it would be paid back, which is also a sign of digging deeper into the debt trap,” maintained the IPR report.

By IANS

WhatsApp us

WhatsApp us

Pingback: สล็อตเว็บตรง

Pingback: ทางเข้า lsm99

Pingback: รับทำเว็บไซต์ WordPress