On Thursday, i.e 21st October 2021, the Union Cabinet chaired by Prime Minister Narendra Modi approved a 3% points on the Dearness Allowance (DA) for Central Government Employees and Dearness Relief (DR) for pensioners over the existing rate of 28% to 31% in order to provide cushion to approximately 4.7 million Government Staff from the rise in the cost of living.

The release of the new hike comes days ahead of the festive season as the government is pining to extend support to a much-needed economic recovery of the nation.

The new hike is aimed to provide benefits to over 47 lakh government employees and 68.82 lakh pensioners. The decision to raise the allowances by the Union Cabinet will have a combined impact on the exchequer Rs.9,488.70 crore per annum.

In a statement, the government stated, “This increase is in accordance with the accepted formula, which is based on the recommendations of the 7th Central Pay Commission. The combined impact on the exchequer on account of both Dearness Allowance and Dearness Relief would be Rs.9,488.70 crore per annum.”

Due to the COVID-19 pandemic, three additional installments of Dearness Allowance for Central Government Staff and RD to pensioners were due and had been frozen from January 1, 2020, July 1, 2020, and January 1, 2021. The decision to release these installments was taken in the Cabinet meeting on 14th July 2021.

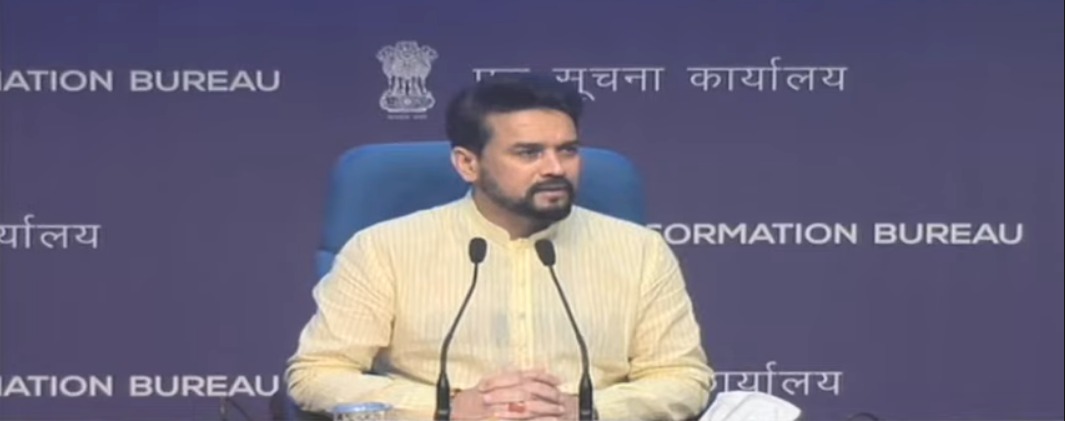

Along with this, Union Minister for Information & Broadcasting, Anurag Thakur also congratulated everyone on achieving the feat of administering 100 Crore Vaccination Mark.

The cabinet committee on economic affairs also approved the PM GatiShakti National Master Plan including a three-tier institutional framework for rolling out the multi-modal connectivity.

What is Dearness Allowance?

The Dearness Allowance is a kind of allowance that is calculated on inflation and allowance paid to government employees and pensioners of India. Dearness Allowance is aimed to mitigate the impact of inflation on people and it is calculated as a percentage of an Indian citizen’s basic salary. The guidelines that govern the DA vary according to where one lives and it is a fully taxable allowance.

WhatsApp us

WhatsApp us

Pingback: ข่าวบอล