Facebook on Wednesday introduced a new payment platform, Facebook Pay. The new service is aimed at making payments easier across Facebook, Messenger, Instagram, and WhatsApp. Currently available in the US only, Facebook Pay comes before WhatsApp Pay roll-out in India which is expected to happen by the end of this year.

What is Facebook Pay?

Facebook and Instagram both allow users to sell products on their platforms. While Facebook has a dedicated Marketplace, Instagram has been expanding its shopping feature. Facebook Pay will allow users to shop, donate to causes, and even send money to friends.

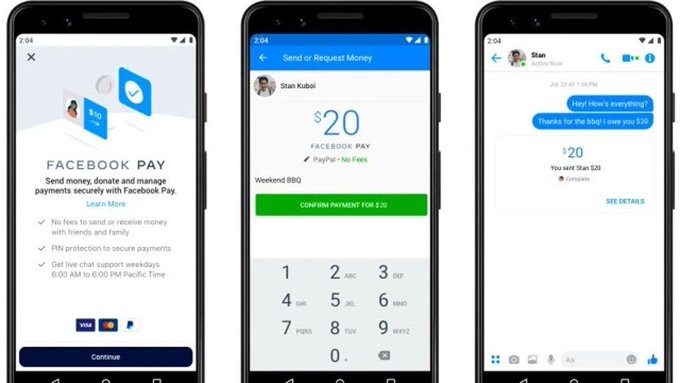

With Facebook Pay, you can add a preferred payment method to make payments. This will do away with the need to re-enter payment information each time you shop. Facebook also lets you set up Facebook Pay app-by-app which means the service isn’t automatically enabled. Users can see their payment history, manage methods, and make changes to the Settings in one place. Facebook will also provide real-time customer support for its new service.

How, where to use it?

If you’re living in the US, here’s how you can set up Facebook Pay.

Step 1: Go to Settings > Select Facebook Pay on the app or website.

Step 2: Select a payment method

Step 3: Whenever you make your next transaction, select Facebook Pay.

Facebook says its new service is compatible with most major debit and credit cards and even Paypal.

Initially, Facebook Pay will be available to Facebook and Messenger. Users can use Facebook Pay for in-game purchases, peer-to-peer payments on Messenger, payments on select Pages and businesses on Facebook Marketplace. You can also use the service to make payments for fundraisers.

WhatsApp Pay

WhatsApp Pay is expected to roll out in India by the end of this year. Based on UPI (Unified Payment Interface), WhatsApp Pay has been available to select users as part of beta trials. WhatsApp Pay has so far focused on peer-to-peer payments.

Users can link their UPI-enabled bank accounts and transfer money through the messaging app. WhatsApp Pay supports all major banks in India such as HDFC, ICICI, State Bank of India, Axis Bank and even Airtel Payments Bank. Users can also send money using UPI ID and QR codes.

WhatsApp us

WhatsApp us