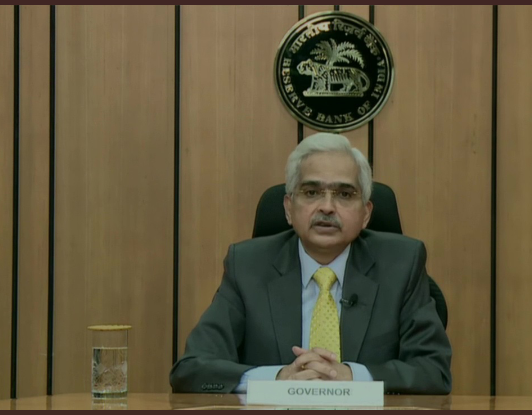

The Reserve Bank of India (RBI) on Friday announced that it expects the Consumer Price Index (CPI) inflation to be 5.1 per cent in the financial year 2021-22. CPI inflation is projected at 5.2 per cent in Q1, 5.4 per cent in Q2, 4.7 per cent in Q3 and 5.3 per cent in Q4 for the financial year 2021-22, with broadly balanced risks, RBI Governor Shaktikanta Das said during the announcements of the Monetary Policy Committee on Friday.

Governor Das said the favourable base effect, which reduced about the moderation in headline inflation by 1.2 percentage points in April, may continue in the first half of the year, conditioned to the progress of the monsoon and effective supply-side interventions by the government.

“Risks to inflation arising from the persistence of the second wave and the consequent restrictions on activity on a virtually pan-India basis. In such a scenario, preparations are made for proactive monitoring and coordination to reduce prices of essential food items from supply-side disruptions. This would require calibrated and timely measures by both the Center and the states to prevent the emergence of supply chain bottlenecks and increase retail margins,” Governor Das added.

Governor Das said that the second wave of COVID-19 has brought unexpectedly higher rates of morbidity and mortality than the first wave. The mutant strains have led to high rates of transmission, resulting in new restrictions on activity across the country.

“Yet unlike in the first wave of Covid-19, when the economy came to a sudden standstill under a nationwide lockdown, the impact on economic activity is expected to be relatively contained in the second wave, with restrictions on mobility to be regional and nuanced,” he said. Having said that people and businesses are already adapting to the working conditions of the pandemic.

However, the RBI revised its GDP growth forecast for the financial year 2022 to 9.5 per cent, from the earlier estimation of 10.5 per cent. It expects GDP to grow at 18.5 per cent in Q1, 7.9 per cent in Q2, 7.2 per cent in Q3 and 6.6 per cent in Q4 of the financial year 2021-22.

WhatsApp us

WhatsApp us