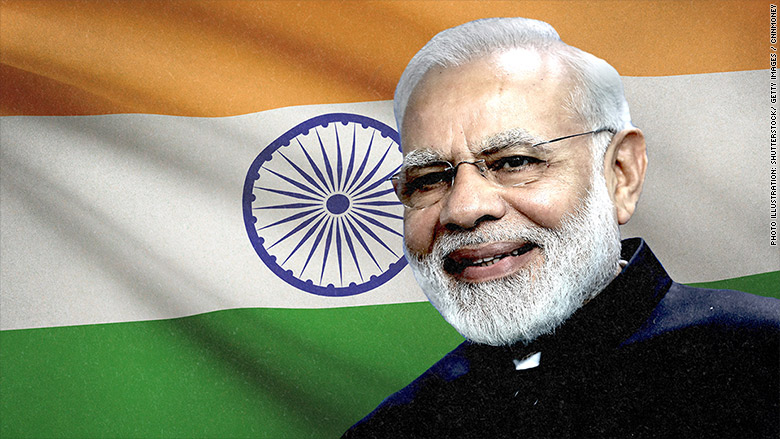

Prime Minister Narendra Modi is offering cheap loans and free accidental insurance coverage to millions of small businesses.

Modi’s Bharatiya Janata Party (BJP) recently announced GST concessions and tweaked an e-commerce policy in favour of small traders.

The government is working on offering a discount of 2 percentage points on loans for businesses with annual sales of less than 50 million rupees ($701,754), the sources said and would compensate banks for costs.

Small businesses with a top credit rating can get loans from banks at about 9-10 percent, while lower-rated businesses can be charged around 13-14 percent.

But only about 4 percent of the 70 million small enterprises in India have access to bank credit, said Praveen Khandelwal, secretary general of the Confederation of All India Traders.

One of the sources said the government may also ask banks to open a special window for increasing the credit flow to small businesses, which will ensure greater availability of loans.

The government is also planning to provide free accidental insurance coverage of up to 1 million rupees to small businesses with annual sales of up to 100 million rupees, the sources said.

“Employees of small traders may also get discounts on opting for state-backed insurance schemes,” one of the sources said.

The government has not yet decided if the moves would be announced before the interim budget on Feb. 1, the sources said.

The government is also considering a pension programme for retired traders registered with the government, and a further discount on interest rates paid on loans to women traders.

WhatsApp us

WhatsApp us