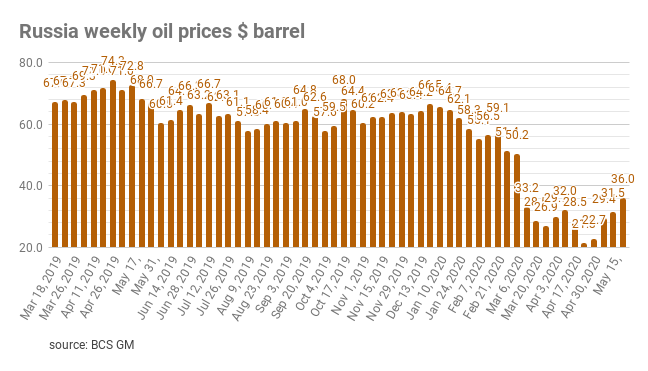

Russia’s leading oil and gas, energy corporations are facing acute market turmoil implicated by the SARS-COV-2 further leading to depression in Entrenched Russian oil markets. Most of the strong oil-exporting companies are vulnerable to the jeopardized coronavirus pandemic. The major companies challenging the headwinds include Rosneft, Gazprom Neft, Lukoil and other small names too featured with limited valuations. The extensive dissemination of the infection spared literally any geography bringing unexpected radical changes to the regulations and pre-existing norms of oil production and exploration mechanisms widespread. One oil corporation CEO in Russia personally visited Russian President Vladimir Putin to explicate about the impact of contemporary oil market fallout and requested him for intervention towards tax exemptions, Easy credit access, deferred loan repayment, intermediate subventions, government bailout policies to be testified by the respective establishment to protect the oil companies from the brink of bankruptcy and revival of future fortunes. Also, he suggested much-needed reforms Russia, ought to bring for better oil trajectory buttressing stable oil exploration possibilities, expanding preferential lending methods and further exemptions from mineral extraction taxes.

* Image sourced from BCS GM journal

In May 2020, oil exports from Russia to the Czech Republic, Germany, Poland and China plummeted by 100%, 15%, 31% and 7% respectively. Exports to Slovakia and Hungary surged by 32% and 3%. Russia has to deal with falling demand for oil and Saudi’s price dumping in Europe, Asia and the US

Saudi Arabia strategically offset Russian dominance in the modern oil market by regaining its lost glory with a series of working potential deals to attract Asian Markets particularly India, Japan and China.

Saudi Arabia is now the leading oil supplier to India beating Iraq.

Saudi Arabia during April exported 1.08 Million Barrels per day to India , outpacing Iraq’s 760,000 barrels per day, according to Kpler officiated data.

Iraq had been the key oil supplier to India since 2017, as it replaced Venezuela and Iran due to sanctions imposed on them by the US.

coming to Indian markets, there’s acute pain in oil imports due to the excess reserves of oil and falling overall demand which accounts to 30% of a substantial slowdown in the rather soaring oil market until the crisis transpired.

Still, To capitalise cheap oil prices and substantially cheapen its oil import bills, India is actively vying for cargoes from the Middle East to quickly fill its petroleum wherewithal to the maximum permissible limits. ADNOC for many years, have been storing crude in ISPRL’s Mangalore underground storage facility and formally forayed into an agreement during 2017 to store crude in Padur, also in Karnataka.

Saudi Aramco framework agreement and MOU with Indian refinery industry to build mega refinery and petrochemical complex will ascertain to be a significant game-changer in the Indian oil industry and strategic pact with RRPCL Ltd supported by GOI will help broaden production capacity of 1.2 million barrels per day. UAE – India oil synergy will engulf greater ties between these nations and helpful for India’s growth story in the imminent future pertaining to oil market .

Analysts forecasts for Indian oil markets are pretty optimistic from FY2021, amidst oil market facing doldrums during this inveterate lockdown crisis and post-recovery period said to be commencing shortly from extensive ease out of lockdown.

About the author

Anand Raghavan

About the author : Electrical Engineer with deep passion towards AI & deep learning. Also an avid writer who likes to research & write about Geo-politics of US & China. Passionate about free markets & foreign trade . Get to know more about me on Twitter @anandaragavan

WhatsApp us

WhatsApp us