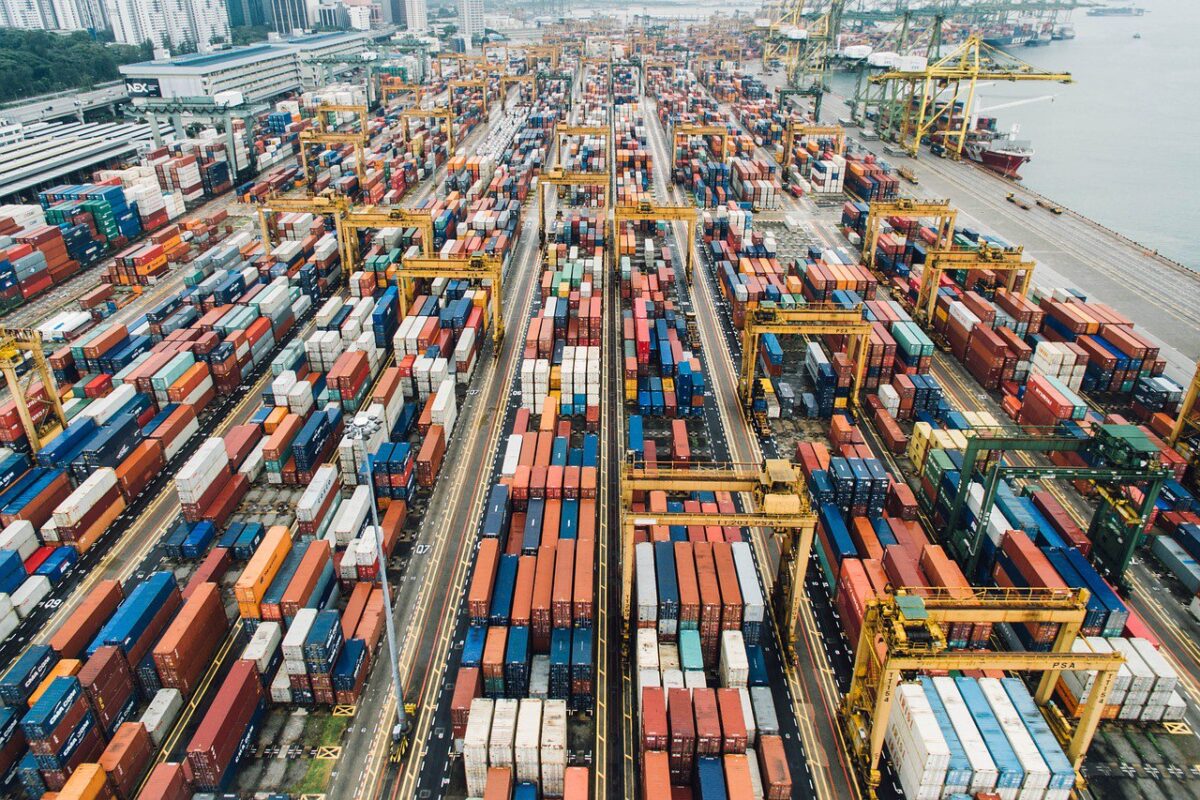

To heighten exports, the government on Tuesday, August 17, 2021, announced rates of tax refund for 8,555 products such as marine goods, yarn, dairy items under the export promotion scheme RoDTEP.

RoDTEP Scheme

The RoDTEP scheme works on the principle, “taxes and duties should not be exported, whereas taxes and duties on exported products should be either exempted or remitted to exporters”.

RoDTEP stands for Remission of Duties and Taxes on Export Products. It’s a new scheme that will be applicable from January 1st, 2021, formed to replace the existing Merchandise Exports from India Scheme (MEIS). The RoDTEP will ensure that the exporters receive refunds on the embedded taxes and duties previously non-recoverable. The scheme was brought to improve exports which were relatively lower in volume earlier.

Need for the RoDTEP Scheme

The US had earlier challenged India’s key export subsidy programmes in the World Trade Organisation (WTO), claiming the scheme to harm the American workers. A dispute panel in the WTO was ruled against India, stating that the export subsidy scheme that was provided by the Government of India (GoI), violated the provisions of the WTO’s norms. The panel further put-forwarded that the export subsidy programmes should be withdrawn. This led to the emergence of the RoDTEP Scheme, to make sure that India stays WTO-compliant.

Rs 12,454 crore to be provided to RoDTEP

Commerce Secretary BVR Subrahmanyam said that Rs 19,400 crore for 2021-22 will be available for both RoDTEP and Rebate of State and Central Taxes and Levies (RoSCTL). The RoSCTL is for the export of apparel and garments.

For the RoDTEP scheme, the amount announced is Rs 12,454 crore and the rest Rs 6,946 crore is for RoSCTL.

Tax refund rates

The tax refund rates range from 0.5 per cent to 4.3 per cent for different sectors. Rebate under the Scheme shall not be available in respect of duties and taxes already exempted or deposited or credited.

How taxes are charged under the scheme?

Under the RoDTEP scheme, taxes, duties and levies are charged on the exported goods at the state and local levels. It refunds the cumulative indirect taxes of the previous stage on the goods as well as the services used in the production of the exported product and their distribution. The rebate will not apply to duties and taxes that have already been exempted, remitted or credited. RoDTEP support will be available as a percentage of Freight on Board (FOB) value to eligible exporters. Rebate on specific export goods will also be subject to the price ceiling per unit of the exported goods.

It will be implemented by Customs through a simplified IT system. The rebate will issue in the form of a Transferable Duty Credit or Electronic Scrip (e-Scrip), which will be kept in an electronic ledger by the Central Board of Indirect Taxes and Customs (CBIC).

Categories that will get the benefits

The employment-oriented sectors such as gems and jewellery, agriculture, leather, marine are covered under this scheme. Other segments like electrical/electronics, automobiles, plastics, machinery are also getting support.

Categories that will not avail the benefits

As per the guidelines, some categories that do not avail of the benefit include export goods that have a minimum export price, restricted and prohibited goods, deemed exports, supply of manufactured goods to SEZs by domestic tariff zone units, and products manufactured or exported by units located in Special Economic Zones.

WhatsApp us

WhatsApp us