So, it was an announcement, by the FM, ahead of the GST council meeting that has changed the narrative about the Indian economy. Will this be short-lived or will it have far reaching effects needs to be observed closely over the next 24-36 months. The major announcements are: (Source: Zee, PIB)

- The corporate tax rates will be brought down from the existing 30% to 22% if the companies do not claim any other “exemption” or “incentives”– the effective tax rate being 25.17%

- For manufacturing companies set up after Oct-1st (if the manufacturing starts before Mar-2023)the tax rate is 15% – the effective tax rate being 17.01%

- Companies that are coming out of the tax holiday can opt for the new tax regime

Disclaimer: for the exact literature please refer to the original text by the government, I’m only capturing the essence

Source: Indsamachar research

Top down approach

By reducing the tax rates the government is clearly taking a top down approach where investments by corporates will lead to job creation and wage growth and as a result the demand at the ground level will pick up, which will lead to further capacity creation and investments – a positive feedback loop. This would improve the GDP growth rate from the last reported ~5% to ~8-10%. There are quite a lot of studies which point towards that:

- A 1% increase in corporate taxes causes a 3% fall in economic output in 3 years, this study was undertaken in the U.S post the World War II

- Another study on the OECD countries showed that reducing corporate taxes could result in a GDP gain of 0.1% to 0.6%. (Source: Taxation and its negative impact on business investment activities, iem).

But as a counter point there is also a paper which talks about cut in tax rates not having substantial impact on the investment in the economy and it depends on a lot of other factors. For example – companies with high promoter holdings will not increase its investments substantially (source: Capital Gains Taxes and Real Corporate Investment*). A lot times scholastic arguments make more sense in the retrospective and very rarely have they ventured into prognostication (at least in Economics and Finance). All said and done, we can expect the profits in the hands of the corporations to go up and reinvestments to happen.

This move has been cheered by the stock markets, which form the visible part of any economy and it needs to be reiterated that this is a structural change and it is deep reaching and will lead to job creation and demand generation over the next 12-24 months, period!

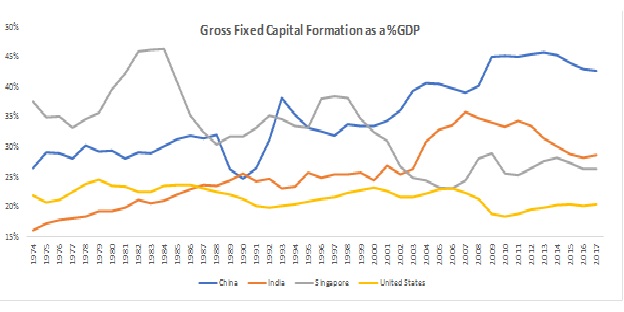

But there are a few other things that we need to be aware of as well. Let’s make a few comparisons China, Singapore, The United States, on two parameters GFCF and Tax revenues (all taxes) as a % of GDP, there are a few interesting things we notice:

Source: World bank, the data for China is not available pre 2005 for taxes

- Maximum Tax revenues – India touched a 12.1% in 2007; Singapore 18.9% in 1984; U.S 13% in 2000; (with its limited data) China achieved 10.3% in 2012

- Average Tax revenues – China and India ~9.7% and 10.7% respectively over the last 10 years, and India has a long-term average of ~9.7%; Singapore at 14.7% and U.S at 10.9%

- Maximum GFCF as a % of GDP – India touched ~36% in 2007; China touched ~46% in 2013; Singapore and U.S touched ~46% and ~24% in the mid to late 80s

- Average GFCF as a % of GDP – India is at ~23%; China at ~32%, U.S at ~22% and Singapore at ~30%

- The tax revenues as a % of GDP has trended upwards in India over 2000s to 2007 and the GFCF as a % of GDP has also trended up which is interesting;

- Post the 2008-09 crisis, the tax revenues in India trended up but the GFCF tapered off (there are quite a lot of other reasons for this) – which could have also been the trigger for this corporate tax rate cut

- India had to wait till the 21st century to touch their peak tax revenues but Singapore and the U.S did it much earlier – does this mean that there is a lot of runway?

The observations above are important in the current context of the corporate rate cuts because every country would have a stable taxable base which would last for a couple of decades before a structural disruption in the business models. The Indian government needs to establish that base for the next 20 years, which can fund this sort of a growth, as every 1% point in tax revenues (as a % of GDP) mean ~1.7lakh crores (this amounts to more than 1.5 month’s GST collections). If this base isn’t established, the government could be chasing its fiscal deficit target every year.

The bottom up approach

If the disposable income goes up instead of corporate investments, the scenario would be interesting. The only variable that can push up disposable income immediately, is the fall personal IT. This would push up the inflation (to get a perspective, notice the block from 2004-2014 in the chart below). Though there were no major tax reforms in the said time period, there were exemptions and deductions that were given for individuals which increased the per capita income, pushing up asset prices and as a result, inflation (crude prices also had a major role to play in this). The Repo Rate actions by the RBI also give an idea that the government was looking to reign in on the inflation.

Source: World Bank; Repo rate definition was changed in 2004;

Disclaimer: The Repo rate chart is a single point wtd average and not the absolute value

The argument above is only to give a case of increasing inflation when the income base goes up during a period of high asset values and is not a scenario where the tax rates have been cut at individual levels.

If a personal tax cut is given now, there would be inflation but the RBI will be left with little cushion from the repo rate angle to fight it (the repo rate pretty low at 5.4%). Also, this inflation could further weaken the demand in the short term, which might not bring in any new investments, leading to lower wage growth and lower spending – a negative feedback loop.

So, it could be confidently argued that the government has weighed in all possible and plausible options before announcing the corporate tax rate cut. Two other factors which could have possibly influenced this decision are:

- Global trade wars and the “Make in India” initiative

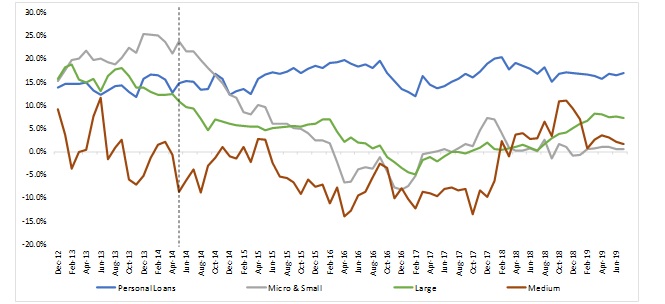

- Slow credit growth in spite of being flush with cash – the chart below shows that the loan growth has fallen off in a secular manner across segments. The slowdown was imminent much before the NPA crisis, DeMon and GST

Credit Growth

Source: rbi.org.in

The way forward

The cut in tax rates gives us a few possible scenarios on which the fate of our economy depends:

- Scenario 1 – the tax rate cut puts more money in the hands of the corporates as profits, this money is reinvested in business over a period of time, which pushes up GFCF, this creates more jobs and wage rates go up (this increases savings and consumption) and as a result the demand goes up which in turn pushes up revenues and profits and the positive feedback loop continues. The increase in corporate revenues and profits also increase the tax revenues for the government, which could neutralize the revenue loss. This positive feedback loop pushes up the GDP. This is the most likely scenario which will play out in the next 24 months.

- Scenario 2 – the tax rate cut puts more money in the hands of the corporates as profits but the corporates play a wait and watch game, which delays their capex spends, which delays job creation and wage growth, thereby delaying recovery. At the same time the government suffers a high fiscal deficit because of fall in revenues and we are left in a similar situation where the growth is slow and the inflation is low

- Scenario3 – the tax rate cut puts more money in the hands of the corporates as profits and there is an aggressive push to create demand at the ground level, by marketing before expanding the capacity. This might make the HHs lever up more, which will increase their interest payments and reduce their disposable income over a period of time which will slow down the demand, keep in mind that the savings level at HH is also low (~17% of the GDP, we have to see if this is the new normal). Now the economy is left with HHs with high leverage, low wage growth and high fiscal deficit. Again a very sticky situation.

All three scenarios above start with the companies receiving higher profits and investing it, which gives us an idea where the ball is currently. Again there is no set path, the economy could oscillate between all three scenarios over the next 24 to 36 months as some of the events of the economic cycle happen linearly and some could happen simultaneously, but like all capitalist economies it is best for the investment cycle to start off from the top.

Author: Kishore Chidambaram works in the treasury dept of a major Insurance company and have got 12+ years experience in Equity Research and Asset management, can be reached on Twitter @kishoreciyer1

WhatsApp us

WhatsApp us