The month of February which got off to a shaky start especially after Budget 2020 and the Reserve Bank of India’s Monetary Policy Committee (MPC). On the domestic front, bears took control of D-Street weighed down by rising concerns of a slowdown in growth, and muted earnings growth for December quarter; while on the global front, rising concerns of coronavirus (COVID-19) ignited risk-off sentiment.

The S&P BSE Sensex plunged 5.96 percent while the Nifty50 was down 6.21 percent in the month of February making it one of the worst monthly fall since September 2018, data showed.

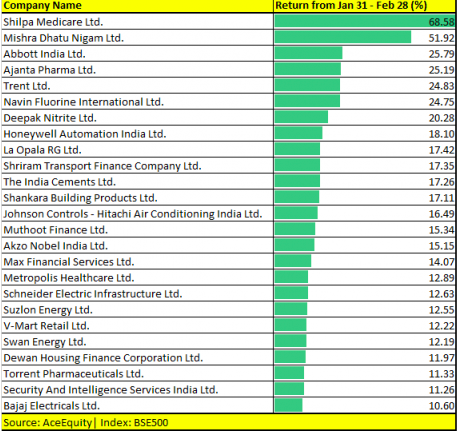

Nearly 400 companies out of the top 500 companies recorded negative returns in February in the S&P BSE 500 index but 25 of them bucked the trend as they rose 10-60 percent in the same period.

Stocks which rallied in double digits at a time when Sensex broke below 39,000 and Nifty50 gave up 11,300 levels. These includes names such as Bajaj Electricals, Swan Energy, V-Mart, Suzlon Energy, Max Financial Services, Trent, Abbott India, and Shilpa Medicare among others.

Only a handful of stocks in the S&P BSE Small-cap index gave positive returns in the month of February. The index plunged 6.5 percent in the month.

Stocks that gave double-digit returns and bucked the trend include Deepak Nitrite, Bajaj Electricals, V-Mart, Metropolis Healthcare, La Opala, Eveready Industries, Navin Fluorine, and Unitech among others.

Some of the small and mid-cap stocks bucked the trend when most of the investors or traders were running for cover. Sentiment on D-Street turned south especially in the past six trading sessions on fears that COVID-19 may turn out to be a bigger threat than what was forecasted, experts suggested.

From risk-on sentiment, it quickly turned into a risk-off sentiment as benchmark indices closed lower by about 7 percent on a weekly basis. The market closed out one of the worst weeks in the last decade.

“The large fall was in the backdrop of COVID-19 infections cropping up in Europe, the Americas and the World Health Organisations’ (WHO) warnings of a global pandemic. This fear combined with the fact that markets had already run-up, has also triggered a ‘risk-off’ attitude amongst foreign institutional investors (FIIs) who have emerged as net sellers this month,”

downtrend was not just limited to Indian markets, but was in sync with global markets as a whole, capping one of the worst weekly sessions for stock markets in recent years,” he said.

Where is the market headed?

The COVID-19 overhang is likely to remain in the first week of March as well as worries of the disease becoming a pandemic from an epidemic is causing concern of global recession, said experts.

The overall global equity markets will continue to have an eye on further development on COVID-19 where if we get any signs of relief then the market is due for a pullback.

“It is difficult to predict the extent and impact of COVID-19, therefore, it is becoming a black swan event for the market and the market does not like uncertainty. Technically, Nifty has a sacrosanct support zone of 11,200-11,100 which coincides with the beginning point of corporate tax cut rally,” Amit Gupta, Co-Founder & CEO, TradingBells told Moneycontrol.

“There is a good chance that the market may stabilise here and witness a pullback rally next week towards 200-DMA of 11,687 and above 200-DMA of 11,687, we can expect further upside where 11,900-12,000 area,” he said.

WhatsApp us

WhatsApp us