In the week Monday 9Th Dec’2019 to Friday 13Th Dec’2019 market closed at +ve note near their previous high and expecting that these indices will make record high in the coming week. True to expectation market opened at +ve note on 16Th Dec’2019. Sensex and Bank Nifty made the new record high within minutes of opening but lost the steam soon. Kotak Bank made a new high which has lost point on 13Th Dec’2019 though the market and many stocks were in uptrend. The expert opinion has fallen flat to their expectation on market and various stocks. Dynamics of Stock market is sensitive & un-predictable.

In order to analyse the questions raised in the concluding para of Part-3A, following stocks are taken for example due to their different performance:

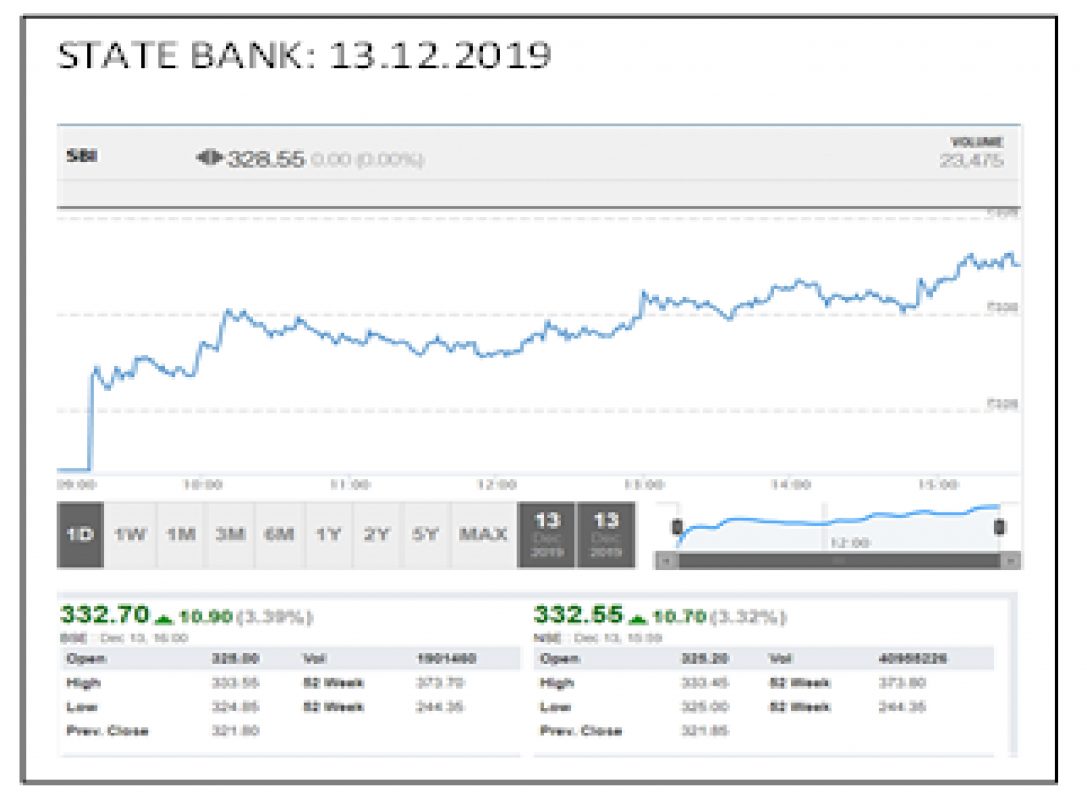

- State Bank: The day chart and Bank Nifty charts were synonymous.

- Kotak Bank: Which has made life time high but has reversal trend.

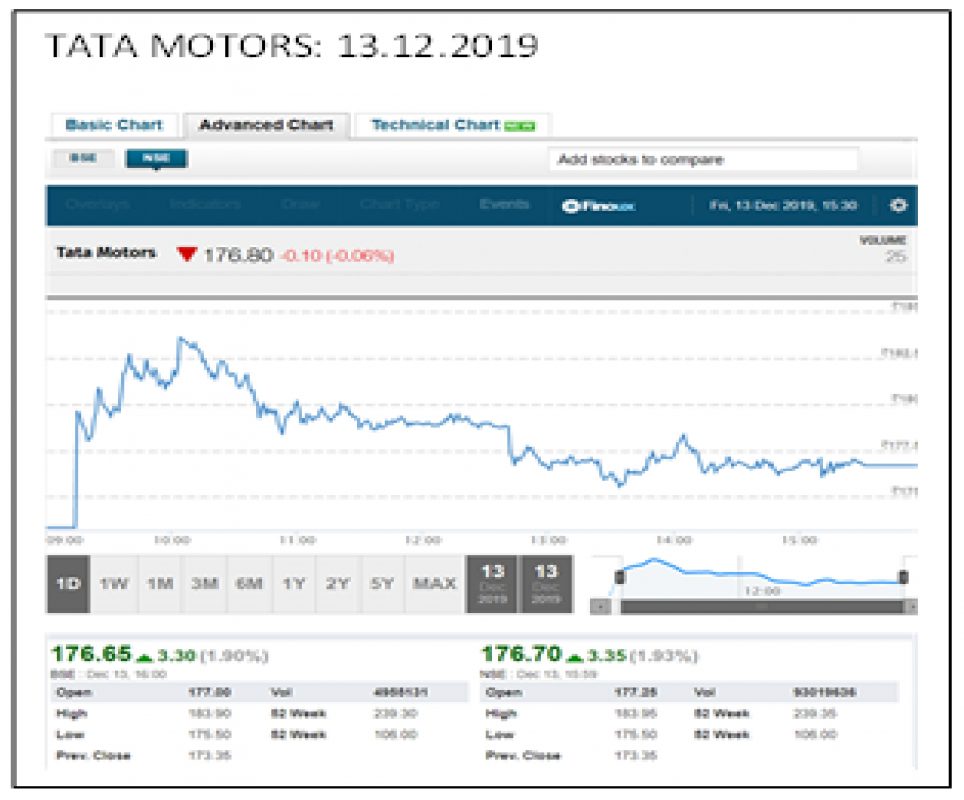

- Tata Motors: Which has performed well on previous day but after gaining few points made a down trend.

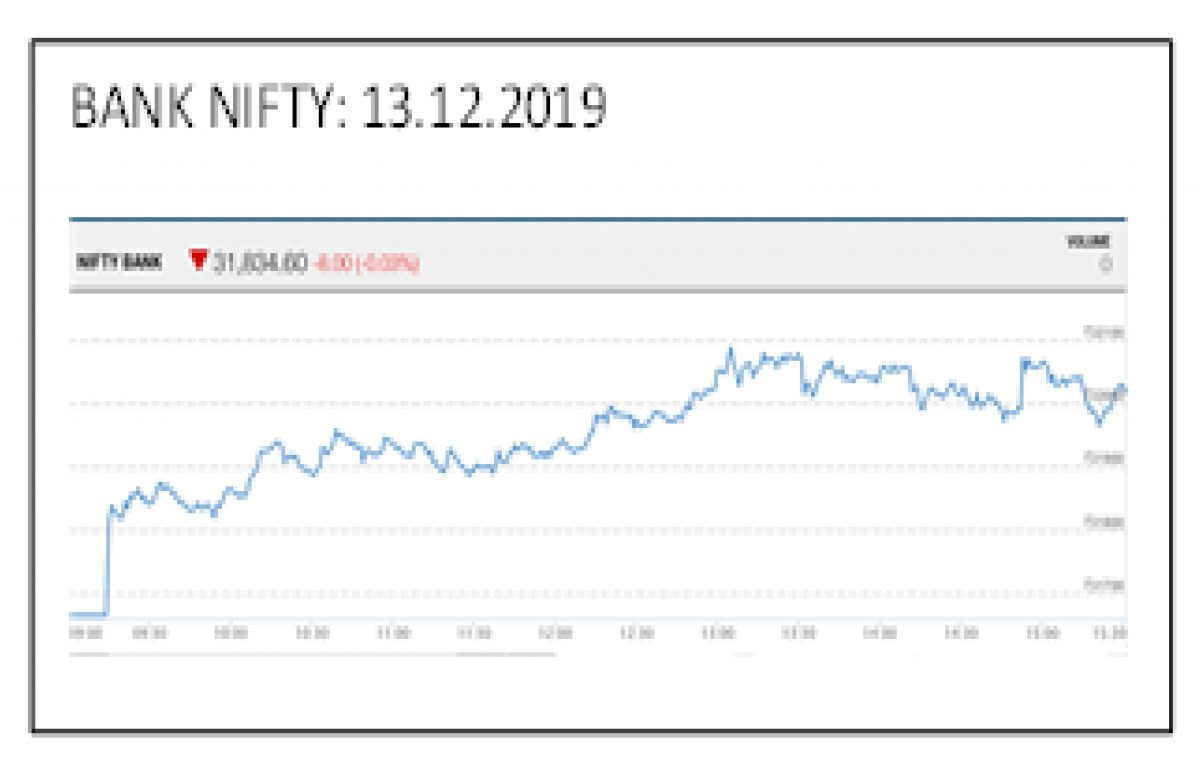

Though Bank Nifty and Nifty50 trend within a rage but on 13Th Dec’2019 it only had uptrend after opening of market and forming similar pattern. Following were the Day Chart Formation of Bank Nifty & Nifty50:

Following are the chart of State Bank and Kotak Bank both of which are listed in Bank Nifty as well as Nifty50 but performed in contrast. State Bank while has up-trend similar to Indices but Kotak had down trend.

Tata Motors had uptrend on 13Th Dec’2019 and a day earlier. With Boris Jhonson winning election and favourable news on US-China trade war, Metal and Tata Stocks were betted to perform well. However, after initial gain the stock took a down trend.

These Trends during the day are difficult to predict & one can hope for the best trade.

For the purpose comparative gain / loss of above if traded in different mode i.e.

- Margin Trading

- Future Trading

- Option Trading

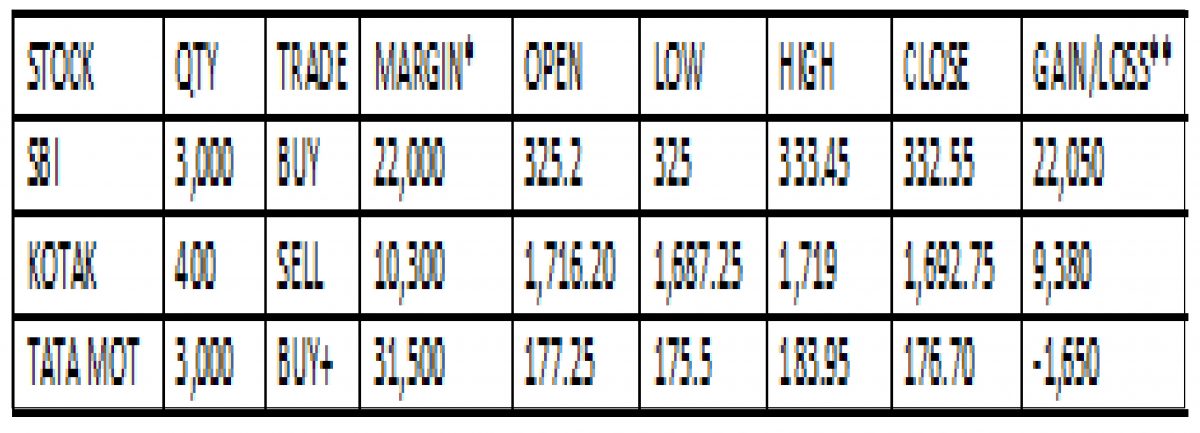

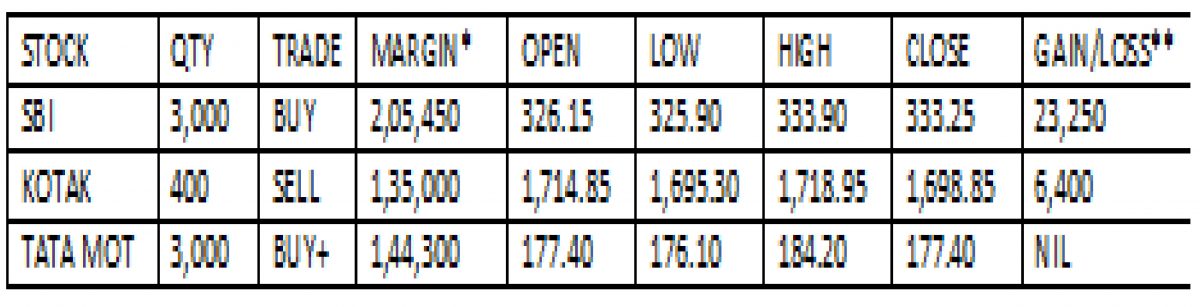

MARGIN TRADING: These trades are taken on spot price basis. For the purpose of comparison, the no. of stocks considered are equal to LOT size of Future and Options.

DATE: 13.12.2019

*These are approximate Margins for the given no. of stocks.

**These are calculated on Open and Closed Prices. Can be maximise if trade is closed at High Price.

+Two-way Trades can be taken – Buy on Opening and Sell at High Price when down Trend started. FUTURE TRADING: Future Trading are done with selected contract that are open for Current Month + Next 2-Months. Prices for every month contract are different & have premium over current month. Every Month Contract expires on Last Thursday of the Month and trade must be closed or before the closing hour of trading sessions. Price in Future are different to spot prices. Future Prices can be either with discounts or premium.

Future Trades can be on Intraday basis or positional basis. The position can be maintained till the expiry of contract i.e. last Thursday of the Month.

DATE: 13.12.2019

*Trade Margins are for Positional Trades. Intraday Margins are lesser. These depends upon the Brokerage House issuing the D-Mat account. Intraday Margins may be 25-35% of positional Margin

**These are calculated on Open and Closed Prices. Can be maximise if trade is closed at High Price.

+Two-way Trades can be taken – Buy on Opening and Sell at High Price when down Trend started.

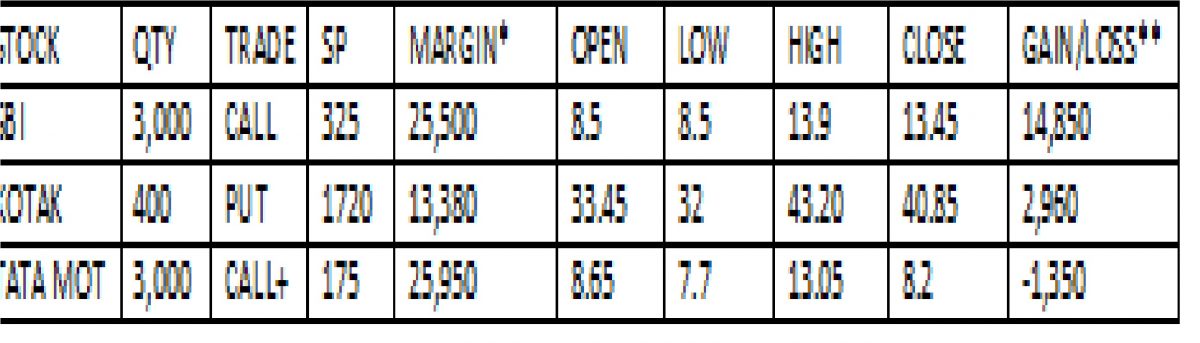

OPTION TRADING: Option Trading are a complex and used for multi applications such as Intraday Trading-Positional Trading-Hedging of Stocks etc. It is not possible nor the intent to deliberate with various modes. The analysis shall be limited for simple “Call & Put Options” for above stocks and Selection of Strike Price Contract.

Buy Call Options = Put Sale = Trading for Long Position i.e Buy of Stock

Call Put Option = Call Sale = Short Position i.e. Sale of Stock

Options are traded by selecting the contract for various “Strike Prices” for Monthly Contract.

Following 3-Terms are Used for selecting the Strike Price

ITM: In Time Money: Where the Strike Price is < Spot Price for CALLOPTION but > Strike Price for PUT OPTION

ATM: At Time Money: Where Strike Price is Near the Spot Price for CALL or PUT OPTION

OTM: Out Time Money: Where Strike Price is > Spot Price for CALL OPTION but < for PUT OPTION.

Premium of Strike Prices Increases for ATM Contracts & Reduces for OTM Contracts

Different Strike Prices gives different Returns. Returns of ITM Contracts are higher than ATM and OTM Contracts.

Analysis for above Stocks are considering ITM Strike Prices

DATE: 13.12.2019

*These are maximum RISK of any contract. However, one can exit any time rather waiting for a total loss.

**These are calculated on Open and Closed Prices. Can be maximise if trade is closed at High Price.

+Two-way Trades can be taken – Buy on Opening and Sell at High Price when down Trend started.

OPTIONS TRADES AT TIME GIVES GOOD RETURNS WITH MINIMUM MARGIN AT RISK.

RISK OF TRADING IN STOCK MARKET:

There are several instances when market trend reversal happens because of some unexpected events or news or because of strategy of major players trapping the traders in losses.

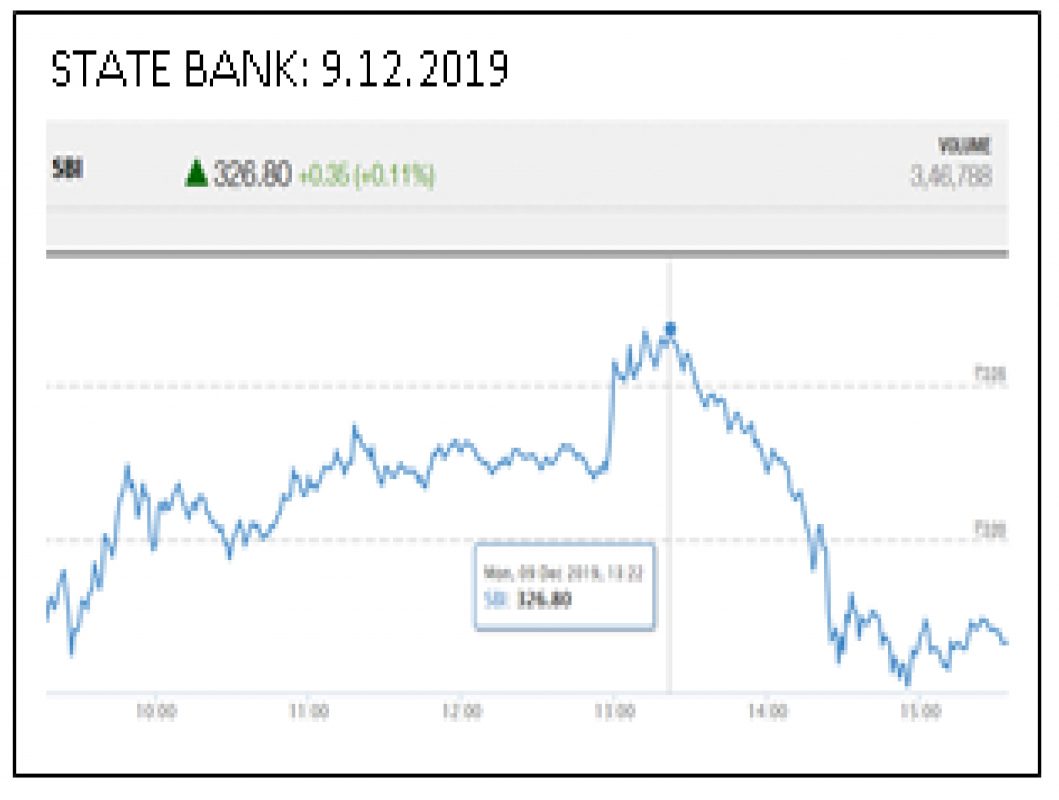

Just to illustrate – Market and key Banking stocks on 9Th Dec’2019 was trading with up trend till 1.22PM but thereafter it started downtrend closing at day low. Similar Trend were in Indices and other stock.

When Selling become heavy is anybody guess. Because of this it is strongly recommended by all experts engaged with market to trade with strict “STOP LOSS” and keep revising it to protect your profits. Many traders and investors get entrapped due to Volatility of market and manipulations of major players (FII & DII)

TO CONCLUDE

If you are trading, learn the basics and arts of trading before indulging for this in Stock Market. It is full time Business and is recommended for serious players. It is rather safe to invest in good Stocks at any dip and keep invested for a considerable time. However, it is in the investor interest to keep the track of the company you have invested in and exit if there is any negative news or poor performance. Today many of the good company with strong fundamental are trading at much lower prices than last one-year prices.

BY JAGDISH SETHI (IIT ROORKE)

A “Project Management Consultant” with over 43-year experience has worked on numerous projects in diverse field (Atomic Power Projects, Chemical & Fertilisers, Food and Pharmaceuticals). Last 16 years executed large EPC project for Water Management as Project Director associated with EPC companies.

Twitter Handle: Jagdish Sethi @jcsethi

WhatsApp us

WhatsApp us